Growth Should Slow as Consumers Run Out of Steam

Views You Can Use: The effects of high interest rates and persistent inflation will likely stifle consumer spending and the economy.

Key Takeaways

While consumers have helped the U.S. economy defy the recession odds, their influence may be waning.

As consumer pressures mount, we believe an economic slowdown will be the most likely scenario.

In our view, higher-quality and more defensive securities may offer value to investors in a slowing or flat economy.

Thanks partly to the robust spending of U.S. consumers, the nation’s economy has remained resilient. Consumers have accounted for nearly 70% of the nation’s gross domestic product (GDP). This influence and significant government expenditures have helped the economy defy the odds and record solid growth despite high inflation and interest rates.

But the factors supporting the extended spending surge are dwindling. And, if historical trends prevail, weaker consumer consumption should thwart growth, slow inflation and ultimately prompt the Federal Reserve (Fed) to cut interest rates. We believe this scenario highlights the important roles high-quality equity and fixed-income securities may play in investor portfolios.

Robust Spending Mimics Prior Pre-Slowdown Periods

A consumer spending wave has preceded every recessionary period since the 1960s.1 During each of the eight economic downturns between 1960 and 2009, there was a period of growth in consumption lasting for two quarters, followed by a recession. Additionally, in prior recessions, private fixed investment declined.2

While today’s economy generally tracks these historical trends, it also contains a noteworthy exception. Private fixed investment remains positive, partly due to the housing market. Unlike in the past, when housing tended to slow the economy, today’s housing market has boosted GDP.

Pressures Are Mounting

We believe the factors fueling this surprising growth run are weakening. Most significantly, consumers have largely depleted the excess savings they accumulated during the pandemic. After soaring to $2.1 trillion in August 2021, cumulative excess savings plunged, approaching its pre-pandemic level of $30 billion in February 2024.3

In addition, wage growth escalated in the post-pandemic economy, further feeding the spending spree. But since peaking in 2022, average hourly earnings have steadily decelerated.4

At the same time, persistently high inflation continued to erode consumers’ savings and wage gains. From January 2021 through March 2024, prices rose 19.4% on average.5

Furthermore, continued support from pandemic-related stimulus has prevented the economy from feeling the full effects of significant Fed tightening. The campaign, which lifted rates 5 percentage points in a 16-month period, has the short-term interest rate target sitting at a 22-year high. We expect the full effects to unfold over the next several months, coinciding with our timetable for an economic slowdown (below-trend growth or recession).

Growth Should Subside in the Coming Months

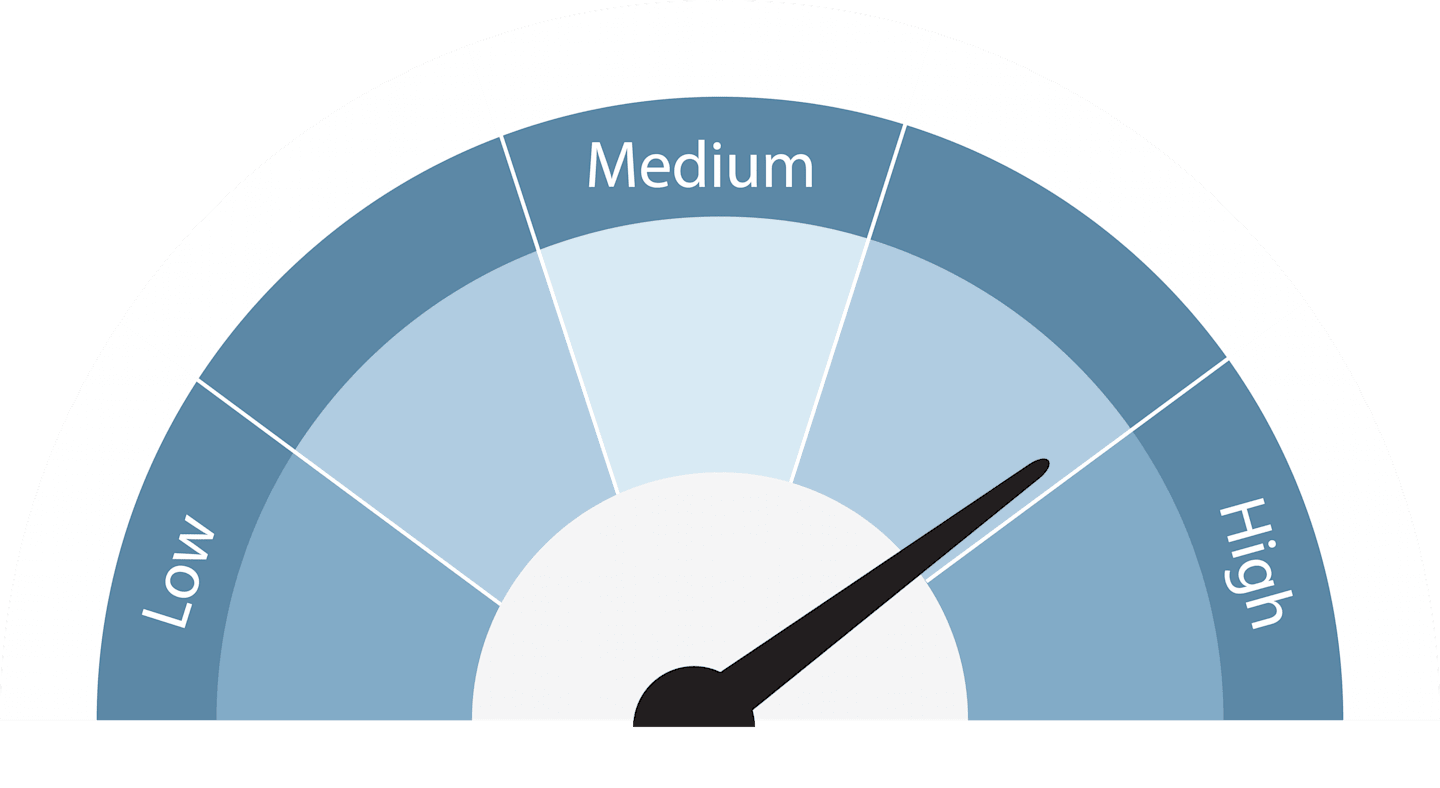

We believe these financial burdens will weigh on consumer spending and eventually stifle GDP. For these reasons, we put the odds of a slowdown sharply higher than other possibilities.

Slowdown: We believe growth will slow to a below-trend pace (flat to slightly positive) for several quarters. We also believe a recession is still possible, though not as likely as anemic growth. We expect the Fed to start cutting rates once the slowdown is evident.

Overheated Economy: We no longer expect a stagflation scenario to unfold. However, we now believe there’s a slim chance of growth surprising to the upside with inflation rekindling.

“Goldilocks:” An economy in which inflation drops to 2% or lower, the Fed quickly eases and growth continues at trend or above-trend levels is a longshot in our view.

What Would a Slowdown Scenario Mean for Investors?

As the economy slows, U.S. Treasury yields will likely fall. We also expect credit spreads to widen. While inflation should moderate, we still expect core inflation (excludes food and energy prices) to remain higher than the Fed’s 2% target in the short term due to:

Continued pressure on the services component of the Consumer Price Index (CPI), mainly from rising wages and elevated shelter (rent and owner’s equivalent rent) costs.

The ongoing repositioning and rerouting of global supply chains and the onshoring of production.

Still-high energy and agricultural (food) prices caused by geopolitical tensions and deglobalization trends.

Slowdown: Potential Investment Implications

We believe a slowdown is likely.

Fixed Income

In a slowdown, investors should consider:

Increasing duration exposure. Diversified strategies with longer durations may potentially offer performance advantages as rates decline.

Staying high in credit quality. In addition to delivering diversification to investor portfolios, a modest allocation to high-quality investment-grade credit may now provide more attractive yields. However, we believe credit selection is critical to avoid weaker, economically sensitive issuers.

Maintaining inflation protection. We believe inflation strategies still appear attractive, given that inflation expectations remain higher than average in the short term.

Equities and Real Assets

In a slowdown, investors should consider:

Emphasizing quality stocks. Quality companies with higher profitability and healthy balance sheets may offer attractive potential. Investors tend to favor quality companies in more defensive sectors, such as utilities, health care and consumer staples. Additionally, we think select dividend-paying stocks that provide consistent income streams are attractive.

Looking to sustainable growth. Companies with dependable, sustainable earnings growth have tended to outperform during economic slowdowns. Economically sensitive value sectors, such as financials, industrials and energy, have tended to lag alongside lowered growth expectations.

Treading carefully in the commodities market. As consumer and industrial demand wanes, commodities typically lose their luster. However, we believe gold may continue to shine amid falling interest rates and heightened economic and market uncertainty.

Limiting exposure to real estate stocks. Real estate investment trusts (REITs) have tended to lag as poor economic conditions weigh on residential and commercial real estate markets.

What Would an Overheated Economy Mean for Investors?

If the economy grows more than expected, inflation will likely remain above the Fed’s target. A growth surprise scenario could also trigger additional Fed tightening.

Overheated Economy: Potential Investment Implications

We believe there’s a slim chance that economic growth will surge.

Fixed Income

If an overheated economy emerges, investors should consider:

Focusing on credit-sensitive assets. Riskier fixed-income securities, including high-yield corporate bonds and bank loans, may offer attractive return potential when the economy is growing.

Maintaining inflation protection. We believe inflation-protection securities, particularly with short durations, are attractive as rates rise and inflation remains elevated.

Avoiding longer-duration assets. With the Fed in tightening mode, longer-duration securities should underperform as interest rates rise.

Equities and Real Assets

If an overheated economy emerges, investors should consider:

Focusing on traditional value sectors. The energy and basic materials sectors have typically benefited from higher commodity prices. Utilities have generally provided dependable cash flows and dividends despite higher inflation and interest rates.

Favoring cyclical stocks. Economically sensitive sectors, such as financials, communication services and industrials, have tended to benefit from strong economic activity.

Gauging commodities. Commodities have historically provided high average returns during periods of economic growth and elevated inflation. However, we believe astute management is required because geopolitics and supply chain issues may heavily influence performance.

Adding exposure to real estate. REITs may outperform their long-term averages as the economy remains robust.

What Would a Goldilocks Scenario Mean for Investors?

If inflation quickly drops to target or below-target levels and the Fed eases monetary policy, Treasury market volatility will likely subside. We would expect Treasury yields and mortgage rates to decline, credit spreads to tighten and the economy to expand at trend or above-trend rates.

Goldilocks: Potential Investment Implications

We believe a Goldilocks scenario is unlikely.

Fixed Income

In a Goldilocks economy, investors should consider:

Evaluating higher-risk bonds. We believe credit-sensitive securities may offer outperformance potential, particularly high-yield bonds and bank loans, which have historically benefited during economic expansions.

Focusing on nimble duration management. Modest growth, lower inflation and a Fed pivot suggest that active duration management may be warranted as markets and rates adjust to the changing backdrop.

Reduce inflation exposure. As inflation subsides, we believe nominal Treasuries may offer better performance potential than Treasury inflation-protected securities (TIPS).

Equities and Real Assets

In a Goldilocks economy, investors should consider:

Looking to growth stocks. Pro-cyclical, growth-oriented sectors historically have outperformed in lower-rate, strong-demand environments. This has been particularly evident in the information technology and communication services sectors, where revenues rely on capital expenditures and advertising spending.

Assessing cyclical sectors, small-caps. Economically sensitive holdings, such as banks and consumer discretionary and industrial stocks, have tended to benefit from increased economic activity. Investors typically focus less on fundamentals, such as quality cash flows, in favor of market beta, at least initially. Small-cap stocks could also offer appeal.

Allocating to REITs. We expect REITs to outperform as the housing market recovers. Additionally, lower interest rates typically boost the attractiveness of REIT yields.

Limiting exposure to certain commodities. We believe industrial metals and other pro-cyclical commodities may outperform as economic activity and demand pick up. However, softer inflation correlates with lower prices for energy and food.

Consider the Effects of a Slowing Economy on Your Portfolio Allocations

In our view, maintaining a broadly diversified portfolio is the appropriate antidote for a changing economic backdrop. But, in a slowing economy, certain investment characteristics deserve consideration.

For example, we believe bond investors should consider tactical allocations to interest rate and credit sensitivity, given the uncertain growth outlook. Remaining nimble may be the best approach for credit-sensitive securities, offering opportunities to potentially capture yield advantages across a range of economic scenarios. And, because we expect inflation expectations to remain volatile, inflation-linked strategies may provide value.

Additionally, we believe focusing on quality in equities and real assets will be crucial over the next several months. In our view, companies able to pass on costs to consumers should be able to protect margins from wage and input cost inflation.

More broadly, emphasizing quality should also help investors navigate a weak or flat economy. In general, we believe that quality companies — those with healthy balance sheets, higher profitability and more stable cash flows — tend to offer attractive performance potential in economic downturns.

Authors

Inflation in Focus

Get market updates, behavioral insights and investment ideas.

Federal Reserve Bank of Dallas, data from 7/1/1960 – 12/31/2023.

Private fixed investment refers to spending by individuals and businesses on durable goods and capital assets (equipment, buildings, housing) expected to provide long-term benefits.

FactSet, San Francisco Federal Reserve Bank.

FactSet, U.S. Bureau of Labor Statistics.

Consumer Price Index.

Past performance is no guarantee of future results. Investment returns will fluctuate and it is possible to lose money.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments' portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Investments in fixed income securities are subject to the risks associated with debt securities including credit, price and interest rate risk.

In certain interest rate environments, such as when real interest rates are rising faster than nominal interest rates, inflation-protected securities with similar durations may experience greater losses than other fixed income securities. Interest payments on inflation-protected debt securities will fluctuate as the principal and/or interest is adjusted for inflation and can be unpredictable.

Generally, as interest rates rise, the value of the bonds held in the fund will decline. The opposite is true when interest rates decline.

Diversification does not assure a profit nor does it protect against loss of principal.